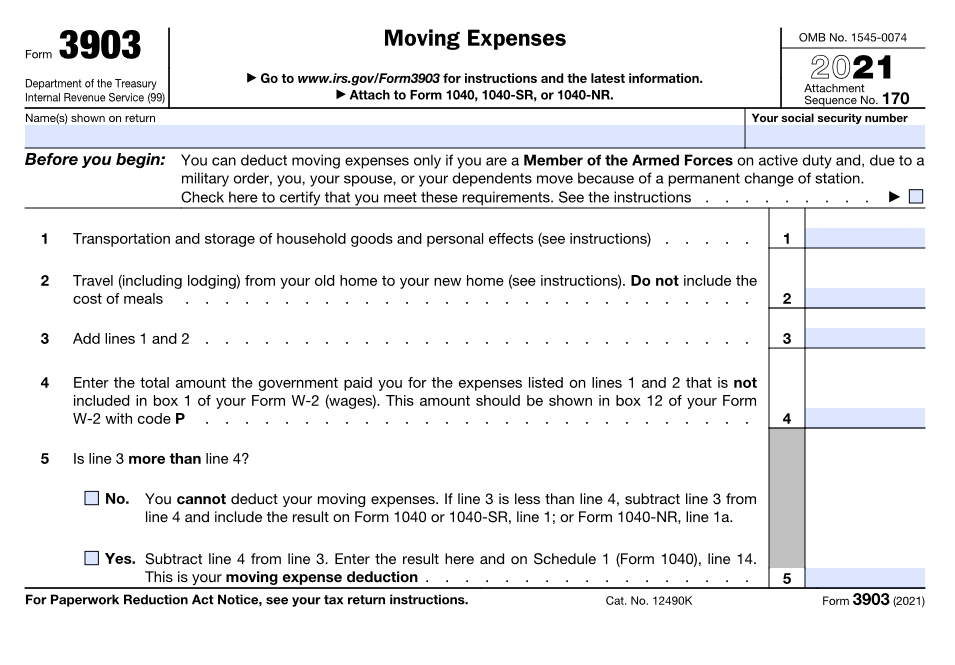

Irs Moving Expenses 2025. This interview will help you determine if you can deduct your moving expenses. Guide on moving expenses tax deductions:

Irs Fsa Eligible Expenses 2025 List Emilia Aindrea, Publication 521 is an internal revenue service (irs) resource that explains the rules for deducting moving expenses on your tax return.

IRS News IRS updates guidance for deductible business, charitable, The deduction for moving expenses associated with permanently relocating for a new job (i.e.

New Tax Twists and Turns for Moving Expense Deductions CPA Practice, The deduction for moving expenses associated with permanently relocating for a new job (i.e.

IRS Moving Expense Deductions A Detailed Guide, Publication 521 is an internal revenue service (irs) resource that explains the rules for deducting moving expenses on your tax return.

Moving Expenses AwesomeFinTech Blog, The irs defines “reasonable costs” as the expenses you incur when you move,.

2018 Tax Reform “Tax Cuts and Jobs Act” ppt download, The irs allows moving expenses to be deducted only if they are reasonable and necessary for relocation.

IRS Form 3903 walkthrough (Moving Expense Deduction) YouTube, Understand eligibility, the process of claiming deductions, and the specific expenses that qualify.

IRS Form 3903 Download Fillable PDF or Fill Online Moving Expenses, Learn how the irs sets the mileage rate, why it matters for tax.

The key changes you need to know for the 2018 tax year ppt download, Learn how the irs sets the mileage rate, why it matters for tax.